Thank you for choosing to make Christian Education affordable for Arizona families.

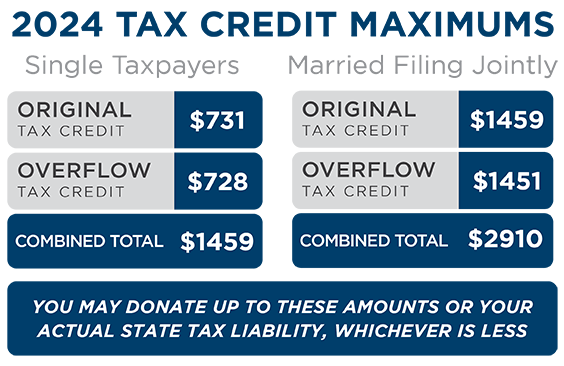

Because of your support since 1998, ACSTO has been able to award more than $346 million in tuition scholarships to 48,500 students! None of this would be possible without you. For Tax Year 2024, a married couple filing jointly can claim a maximum credit of up to $2,910, a single taxpayer up to $1,459, or their total tax liability—whichever is less.

We want the donation process to be as easy as possible for you, so we offer multiple ways to make your contribution to ACSTO.

You can donate online through our Donor Portal. If you’ve never donated to ACSTO before, you’ll have the opportunity to create an account which enables you to print your receipt, view your donation history, and will make donating again next year even faster! You can also set up monthly donations if giving smaller amounts throughout the year works better for you. If you don’t want to create a Donor Portal account, you can also Donate as a Guest.

BY MAIL

Prefer to donate by mail? Fill out a Donation Card from one of our brochures and mail it with your check or credit card information to:

ACSTO

PO Box 6580

Chandler, AZ 85246

| Donation Brochure | Color | Grayscale | Donation Card |

|---|---|---|---|

| Out of State Brochure | Color | ||

BY PHONE

Want to make your donation by phone, or have questions about how to make your donation? Call us today at 480.820.0403—we’d love to help! Our Customer Service Specialists are available Monday–Friday from 9am–12pm and 1pm–4pm.